Page 67 - EXPORT MAGAZINE

P. 67

REPOR T

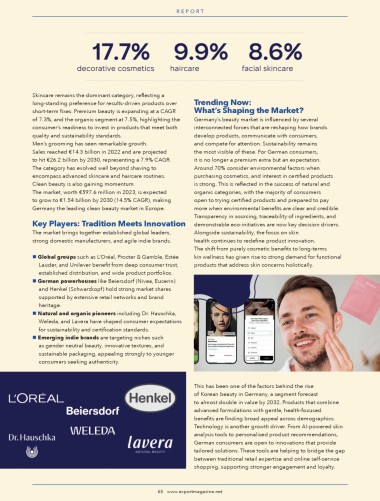

Skincare remains the dominant category, reflecting a

long-standing preference for results-driven products over Trending Now:

short-term fixes. Premium beauty is expanding at a CAGR What’s Shaping the Market?

of 7.3%, and the organic segment at 7.5%, highlighting the Germany’s beauty market is influenced by several

consumer’s readiness to invest in products that meet both interconnected forces that are reshaping how brands

quality and sustainability standards. develop products, communicate with consumers,

Men’s grooming has seen remarkable growth. and compete for attention. Sustainability remains

Sales reached €14.3 billion in 2022 and are projected the most visible of these. For German consumers,

to hit €26.2 billion by 2030, representing a 7.9% CAGR. it is no longer a premium extra but an expectation.

The category has evolved well beyond shaving to Around 70% consider environmental factors when

encompass advanced skincare and haircare routines. purchasing cosmetics, and interest in certified products

Clean beauty is also gaining momentum. is strong. This is reflected in the success of natural and

The market, worth €597.6 million in 2023, is expected organic categories, with the majority of consumers

to grow to €1.54 billion by 2030 (14.5% CAGR), making open to trying certified products and prepared to pay

Germany the leading clean beauty market in Europe. more when environmental benefits are clear and credible.

Transparency in sourcing, traceability of ingredients, and

Key Players: Tradition Meets Innovation demonstrable eco-initiatives are now key decision drivers.

The market brings together established global leaders, Alongside sustainability, the focus on skin

strong domestic manufacturers, and agile indie brands. health continues to redefine product innovation.

The shift from purely cosmetic benefits to long-terms

n Global groups such as L’Oréal, Procter & Gamble, Estée kin wellness has given rise to strong demand for functional

Lauder, and Unilever benefit from deep consumer trust, products that address skin concerns holistically.

established distribution, and wide product portfolios.

n German powerhouses like Beiersdorf (Nivea, Eucerin)

and Henkel (Schwarzkopf) hold strong market shares

supported by extensive retail networks and brand

heritage.

n Natural and organic pioneers including Dr. Hauschka,

Weleda, and Lavera have shaped consumer expectations

for sustainability and certification standards.

n Emerging indie brands are targeting niches such

as gender neutral beauty, innovative textures, and

sustainable packaging, appealing strongly to younger

consumers seeking authenticity.

This has been one of the factors behind the rise

of Korean beauty in Germany, a segment forecast

to almost double in value by 2032. Products that combine

advanced formulations with gentle, health-focused

benefits are finding broad appeal across demographics.

Technology is another growth driver. From AI-powered skin

analysis tools to personalised product recommendations,

German consumers are open to innovations that provide

tailored solutions. These tools are helping to bridge the gap

between traditional retail expertise and online self-service

shopping, supporting stronger engagement and loyalty.

65

65 www.exportmagazine.net www.exportmagazine.net